While debt can be a part of life for most people, there are both good and bad forms of debt.

No-one really likes having debt, but knowing the different types and how to manage them may save you money and give you a better lifestyle.

Good debt Vs Bad debt

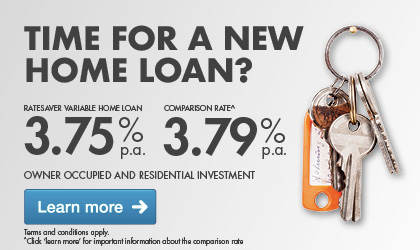

Sometimes debt is a necessity. Take buying a home for example. Few people can buy their home outright, so borrowing money for this purpose is generally seen as “good” debt as it is debt borrowed on an asset that can appreciate in value.

Also, very few people can afford to buy their home outright.

“Bad” debt is usually debt such as credit cards and personal loans. You could look at bad debt as borrowing money to purchase depreciating assets, such as cars, clothes and electronic goods such as iPads and computers.

Reasons to pay down bad debt

Now that you know the difference between good and bad debt, it is time to understand the advantages of paying off that bad debt as quickly as you can.

If you can think of further ways that paying off debt could impact your life let us know in the comments below.

1. Debt can be all-consuming if you let it get out of control

You can end up working just to pay back money you have already spent, and playing catch-up is both exhausting and stressful. Not to mention it’s difficult, if not impossible, to get ahead when all you are doing to paying off old debt.

2. You have more money to enjoy life

With no debt repayments you tend to have more money to spend. Dinners out with friends, holidays, road trips to the beach – all of these things are more possible if you are not using that money to pay off your debt instead.

3. Save for the important things faster

You could be saving faster for those important things in life – like that trip overseas or the deposit for your own home.

4. Becoming an entrepreneur

Want to run your own business and be your own boss? Want to be able to work anywhere in the world? These are all the more possible when you are debt-free and able to save and manage your money better. Imagine being able to self-fund your startup, or have enough money to market that killer app.

5. Improved credit history

Defaulting on your bills or any debts can cause you to have issue later in life when you want to borrow money for those “good” debt purchases like a home.

6. Increased future earnings

By saving more now (rather than using that money paying off debt) you can earn more later in life. This could be done through increased investments and savings, or using that money to gain more knowledge through study and training, which could have a positive impact on your future wage levels.

7. Early retirement

Imagine retiring at 30. This is much more likely if you pay off any bad debt early and get your money working for you.

How to pay off your bad debt?

So, now you know why it is so important to pay off your bad debt, how do you go about it?

Step 1: Don’t ignore it

Make sure you face up to your debt, no matter how much of it you have. Ignoring it won’t do you any good (especially in the long term).

Step 2: Know how much you owe

Get an understanding of your level of debt. Write down all your debts and total them up. This may be scary for some people, but it is a great first step in managing your debt levels.

Step 3: Sort your debts

Once you have a list of all your debts, work out which you should pay off first. Any urgent or over due debt should be looked at as a priority as they may be incurring late fees or other penalties, but after that you can look at managing your remaining debt.

Step 4: Debt Consolidation

If you have two or more debts you may want to consider a debt consolidation loan. Combining your debt into one, easy to manage loan can save you time, money and stress. Why make three or four different repayments each month, when you could make one simple repayment?

Plus, interest rates for a debt consolidation loan may be significantly less than what you are charged on your existing debt, particularly if you owe money on a credit card or store card.

Learn more about our debt consolidation loans.

Moving from a debt-filled to a debt-free life can be a long road, but as you have seen the benefits for doing so can be significant indeed.

And the earlier you start, the easier it will be. And the more time you will have to enjoy life once you have gotten rid of all that bad debt.

Have you started down the debt reduction road yourself yet? Planning on it?

Comments (0)

Add a Comment