Choosing your new home is never an easy process.

You may be buying your first home, moving into a bigger property, or even deciding to downsize – no matter what new home you are looking for, price is a major concern.

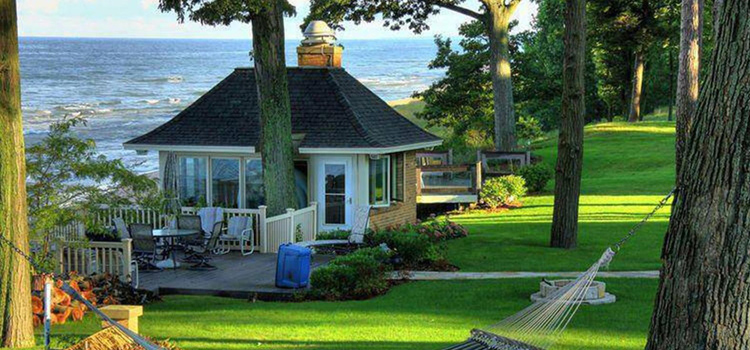

Finding your dream home can be difficult

Finding a property you are happy with, in a nice location, for the right price can be difficult – especially in the major capital cities.

You can make your job easier by narrowing down your favourite suburbs, thinking about what size home you will need, what type of dwelling you are after, and so on.

But no matter what home you are after, one of the biggest choices you will make is choosing which financial institution you take out your mortgage with.

Stop before making any final decisions

Before making any final decisions, it might be a good idea to think about what impact the mortgage you choose has on what home you can afford.

Once you have your mortgage, the repayments are dictated in part by what the mortgage’s interest rate is. The lower this interest rate, the less your repayments will be.

For example, if you could save $40k on the life of your loan – a $133 saving per month – you could either bank that money or use it to buy the house you really want.

Compromising on your dream home is always difficult, but you can make this easier and tick as many boxes as possible by having lower repayments. Knowing you have a great deal on your home loan, will allow you to feel a great deal more comfortable with your final decision.

An affordable dream

It is always wise to make sure you can comfortably afford any repayments if interest rates increase in the future, but having a lower interest rate (and thus smaller repayment) to start with can make a big difference to what you can afford now and in the future.

Having a mortgage with an interest rate that could save you $40K over the life of the loan – a $133 saving per month – could mean you get exactly the home you are after, rather than one you settle for.

If you would rather live in your dream home, then perhaps you need to talk with us.

Comments (0)

Add a Comment