It looks like you are using an older browser. From Tuesday 16th August 2016, a security upgrade to NetBanking will mean that people using older browsers will not be able to access NetBanking.

Find out more about updating your browser.

To avoid inconvenience, please upgrade your browser immediately. Directions on how to do so can be found by clicking on the title of your chosen browser. Internet Explorer, Chrome, Firefox, Opera or Safari.

- Home

- Accounts

- Loans

- Insurance

- Cards

- Foreign Exchange

- Something Extra

- Financial Planning

- Car Buying Service

- Merchant Facilities

- Mobile Banking

- Google Pay

- Calculators

- Home Loan Repayments Calculator

- Home Loan Lump Sum Calculator

- Home Loan Comparison Calculator

- Home Loan Extra Repayments Calculator

- Home Loan Borrowing Calculator

- Home Loan Stamp Duty Calculator

- Home Loan Split Loan Calculator

- Car Loan Repayments Calculator

- Personal Loan Repayments Calculator

- Financial Planning Retirement Gap Calculator

- Financial Planning Salary Sacrifice Calculator

- Savings Calculator

- Term Deposit Calculator

- Income Tax Calculator

- Budget Calculator

- Keep your money safe

- Updating your browser

- Latest Offers

- About Us

- Internet Banking

- Contact Us

Accounts

Transaction Accounts

Savings Accounts

Business Accounts

Loans

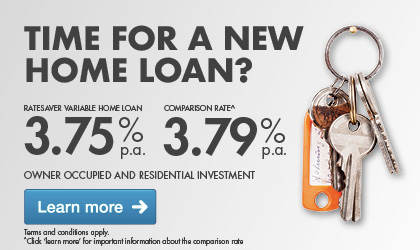

Home Loans

Personal Loans

Business Loans

Insurance

Something Extra

- Financial Planning

- Car Buying Service

- Merchant Facilities

- Mobile Banking

- Google Pay

- Calculators

- Home Loan Repayments Calculator

- Home Loan Lump Sum Calculator

- Home Loan Comparison Calculator

- Home Loan Extra Repayments Calculator

- Home Loan Borrowing Calculator

- Home Loan Stamp Duty Calculator

- Home Loan Split Loan Calculator

- Car Loan Repayments Calculator

- Personal Loan Repayments Calculator

- Financial Planning Retirement Gap Calculator

- Financial Planning Salary Sacrifice Calculator

- Savings Calculator

- Term Deposit Calculator

- Income Tax Calculator

- Budget Calculator

- Keep your money safe

- Updating your browser

About Us

- Become a member

- Merger update

- About Queenslanders

- Compliments and complaints

- What our customers say

- The credit union difference

- Latest news

Documents

Club Hero