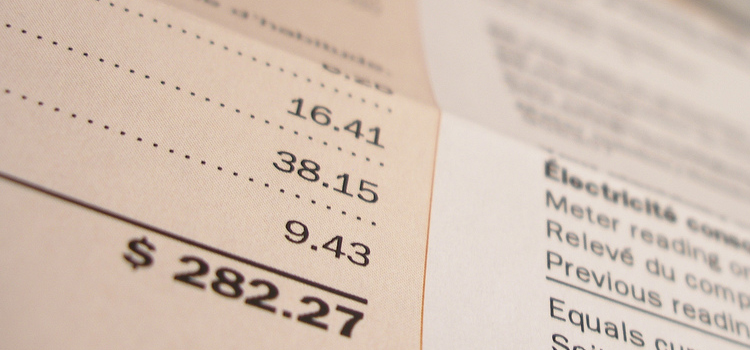

Bills are expensive.

And they seem to get worse each month. Personally, they account for about 20% of my total income. That’s one dollar in every five which goes towards a bill. That’s too much!

Your say: What percentage of your income goes on bills? Let us know in the comments below.

So, trying to reduce or eliminate as many bills as possible can be a smart way to lower your costs and have more money for yourself.

The goal then is to look through all your bills and decide which ones you will eliminate or which ones you will lower.

How?

First, make a list of every bill you receive, not forgetting about those you receive electronically or those that occur quarterly or even annually. After you have your list, think carefully about each one. Do you really want or need this service?

You may find it a handy first step placing your bills into two piles:

- Absolutely needed

- All others

Be thoughtful when placing each bill into a pile and really think about whether or not you need the service. This is a fairly individual thing to do, and all households are going to be different.

For example, I would place bills like electricity, gas and internet into the “absolutely needed” pile, while bills like mobile, home phone, pay TV into the “all others” pile.

The reason I placed internet into the needed pile is because I need the internet on at home for work, and the mobile into the other pile because I get a work mobile and having two mobiles seems excessive.

This may not be the case for everyone however, and you may be happy to surf the web on your mobile device rather than having the internet on at home.

No matter what bills you put in which pile, the real trick is to be strict with yourself.

The Next Step

Then, as they come in to be paid, make a decision:

1. Eliminate

OR

2. Reduce

1. Eliminate Cancel the service. End of the bill. More money for you!

2. Reduce Try your hardest to reduce the bill. There are a few options available to you to reduce your bill. Here are some of the more obvious ones:

Call to see if you can get a discount

This can work with almost any bill as most companies have competitors they don’t want you leaving them for. Use this as a way of leveraging a discount.

Go with a competitor

If your current provider won’t help you out, do your research and switch to a cheaper provider.

Move to a cheaper plan

Pay TV, mobile, and even home phone providers usually have multiple plans. Think about your usage of the service and change to a cheaper plan which will still allow you to enjoy the service at a cheaper price.

Combine two or more services

Think home phone and internet, mobile and internet, or all three together. Also, some Pay TV providers also provide internet services. Check out your options and save money by combining services and receive a discount for doing so.

Be careful with combining services however, you don’t want to pay more for stuff you will never use. Make sure you are indeed saving money by combining services, and think about whether you would rather eliminate one (or more) instead.

Over to you

I have listed four of the more obvious ways to lower your bills, but now it’s your turn – what other ways are there to reduce what you are paying?

Whether you eliminate or lower each bill, you are making a positive impact on your savings and lifestyle. What you do with the money you save is up to you, but at least you will have that decision to make.

Comments (0)

Add a Comment